capital gains tax canada calculator

Mario calculates his capital gain as follows. ICalculator is packed with financial.

Capital Gains Tax Calculator For Relative Value Investing

2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

. 21 hours agoThe time to understand Schedule 3 to calculate capital gainslosses under various categories is now. Lifetime capital gains exemption limit For dispositions in 2021 of qualified. In the case of capital gains the rates depend on the holding period and are classified as.

For the calculation of capital gains and capital gains tax liability subtract your adjusted basis from the sales price of the property then multiply it by the capital gains tax rate. Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. These income thresholds increase to 459750 for single taxpayers and to 517200 for.

This entry is required. Since its more than your ACB you have a capital gain. The sale price minus your ACB is the capital gain that youll need to pay tax.

Do not include any capital gains or losses in your business or. Annual Stock Option Grants Inputs. Proceeds of disposition Adjusted cost base Expenses on disposition Capital gain.

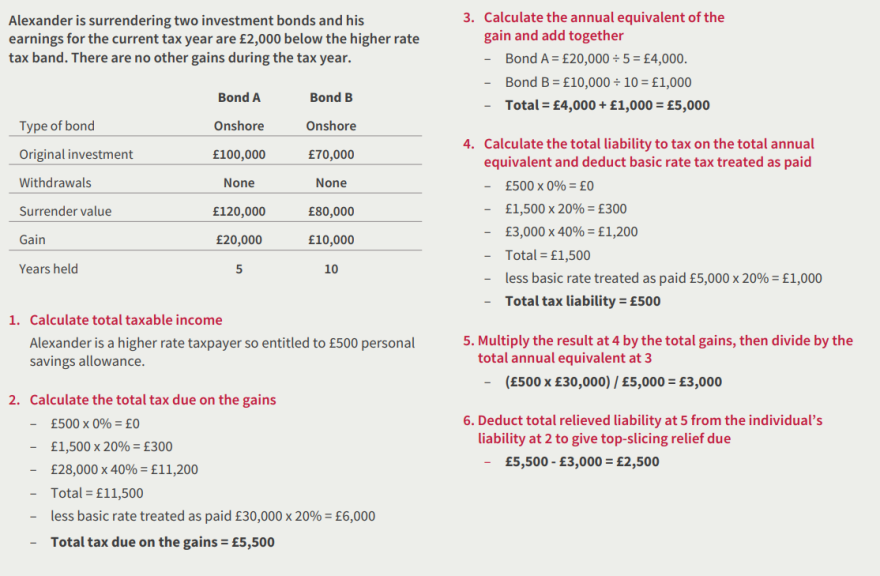

Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

Calculating your capital gain or loss. Adjusted cost base plus outlays and expenses on disposition. All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223 tax year.

How Much Are Stock Options Taxed In Canada. For a Canadian who falls in a 33 marginal. Short-term capital gains tax taxes on assets that are held for less than a year.

You will need information from your records or supporting documents to calculate your capital gains or. 6500 - 4000 60. Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces.

How to calculate capital gains tax. And the tax rate depends on your income. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions.

Locate current stock prices by. The calculator on this page is designed to help you estimate your. To determine if a treaty applies to you go to Status of.

The federal tax rates for 2021 can be found on the Canada Revenue Agency CRA website. Capital gains tax is calculated as follows. The rates of the online calculator apply only if you are a non-resident of Canada who is entitled to benefits under a treaty.

The things you need to know to calculate your gain or loss like the inclusion rate adjusted cost base ACB and proceeds of disposition. Find out your tax brackets and how much Federal and Provincial. The Canadian Annual Capital Gains Tax.

Your sale price 3950- your ACB 13002650. Capital Gains 2021. For instance if you sell a.

Completing your tax return.

2020 Income Tax Calculator Cheap Sale 52 Off Www Ingeniovirtual Com

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

2020 Income Tax Calculator Cheap Sale 52 Off Www Ingeniovirtual Com

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Taxtips Ca On Twitter Basic Canadian Tax Calculator This Very Simple Taxplanning Calculator Which Shows Marginal Tax Rates For All Provinces And Territories Now Includes The Additional Federal Personal Tax Credit For 2020

How To Calculate Cost Basis In Crypto Bitcoin Koinly

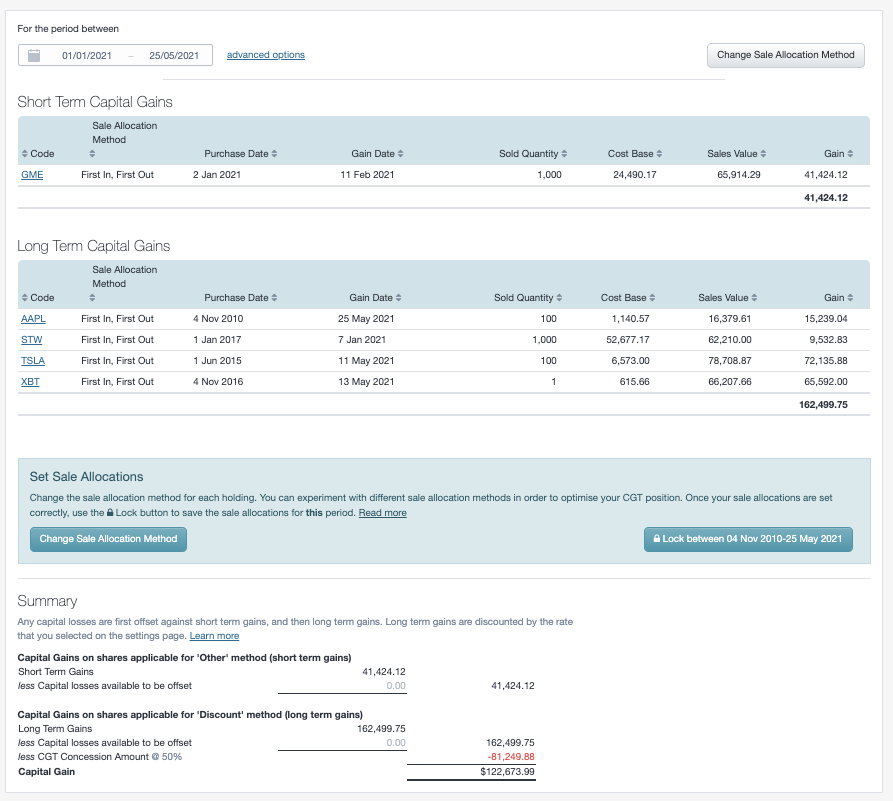

Capital Gains Tax Cgt Calculator For Australian Investors Sharesight

Gst Evasion Firm Busted For Claiming Bogus Input Tax Credit Worth Rs 281 Crores Filing Taxes Income Tax Income Tax Return

How To Create An Income Tax Calculator In Excel Youtube

Excel Formula Income Tax Bracket Calculation Exceljet

Capital Gains Tax Calculator Ey Global

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Interest Only Loan Calculator Calculate Interest Only Mortgage Payments By Inserting The Appropriate L Interest Only Loan Tax Accountant Interest Only Mortgage

Calculating Sales Efficiency In A Startup The Magic Number That Will Help You Scale Techcrunch Magic Number Enterprise Business Start Up